Surveying Tools

Tools for Surveying and Sourcing Participants

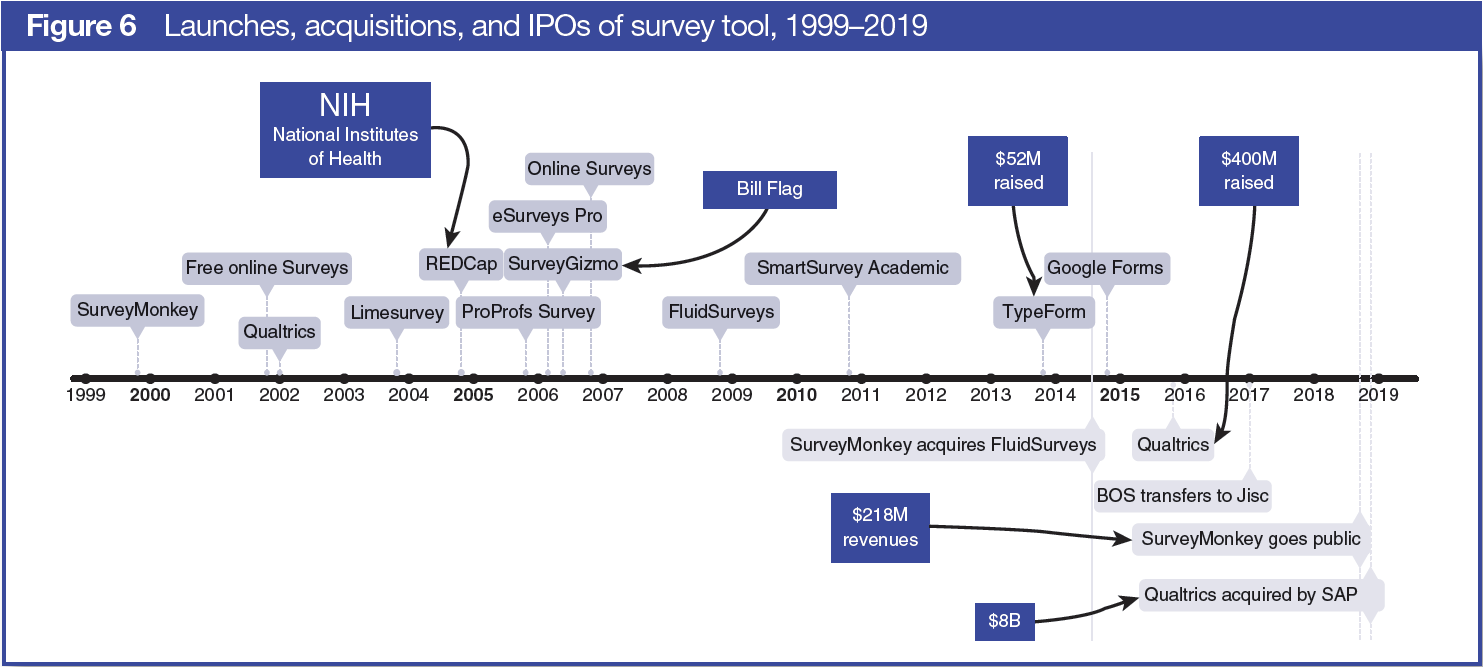

Surveys are probably the most common method for data collection in the social sciences. Researchers used to carry clipboards, but now there are more than 50 different software tools for surveying. The timeline in Figure 6 shows a select number of survey tools and illustrates how varied this space is: There are free and open source tools, tools developed specifically for academics (REDCap, Bristol Online Surveys, SmartSurvey Academic), some that developed quickly and raised a lot of money (TypeForm), and others that have been less successful. Some acquired competitors and went public (SurveyMonkey), and some had backing from angel investors (SurveyGizmo). This part of the market is still shifting, with old and new entrants, acquisitions, and fundraising, and yet more will come, with machine learning having the potential to transform the way we conduct surveys.

Of the surveying tools developed specifically for academics, the most popular one is REDCap. REDCap is an open source survey and client relationship management tool (CRM) developed initially for clinical research and funded by the National Institutes of Health (NIH). The tool grew a large supporting community and is now used across disciplines by researchers who are comfortable with coding and concerned with privacy, i.e., where person-identifiable data is stored.

Qualtrics may appear to be a recent entrant (their first press release was in 2012), but they have been earning revenue since 2002, and by late 2016 they had raised almost $400M to develop an advanced surveying platform for research and business. Qualtrics is popular among social science researchers and is considered an innovative company (Qualtrics, 2019); it can source respondents and interface with almost anything, including games and custom- built tools. At the end of 2018 it was acquired by a business solutions company for $8 billion (SAP, 2019), after having turned down another offer for $500k a few years earlier, according to a TechCrunch story (Andersen, 2013).

Whilst with most existing surveying tools researchers are responsible for sourcing their own participants, there are now a number of tools that can help with recruitment (Figure 7). The most commonly used is Amazon’s Mechanical Turk, though arguably the best one for academic research is Prolific. Prolific (also known as Prolific Academic) was set up in 2014 by then-PhD student Ekaterina Damer, who was herself struggling with participant recruitment. Through the Oxford Innovation Incubator, Damer and her team developed a minimum viable product in four weeks, and in less than a year they grew both the participant pool and the researcher (user) community rapidly. Prolific integrates with a number of surveying and online experiment platforms (Lumsden, 2019) and, at the time of writing, has 45,000 participants from across the globe.